Thanks to those who signed up yesterday! I don’t have plans for a specific schedule of posts, but I’m looking to post something 3-4 times a week which will typically be long form posts. Subscribers will get notifications via email, but everyone is welcome to view via the website as well. If you have ideas for topics/posts you’d like to see, I look forward to seeing your comments.

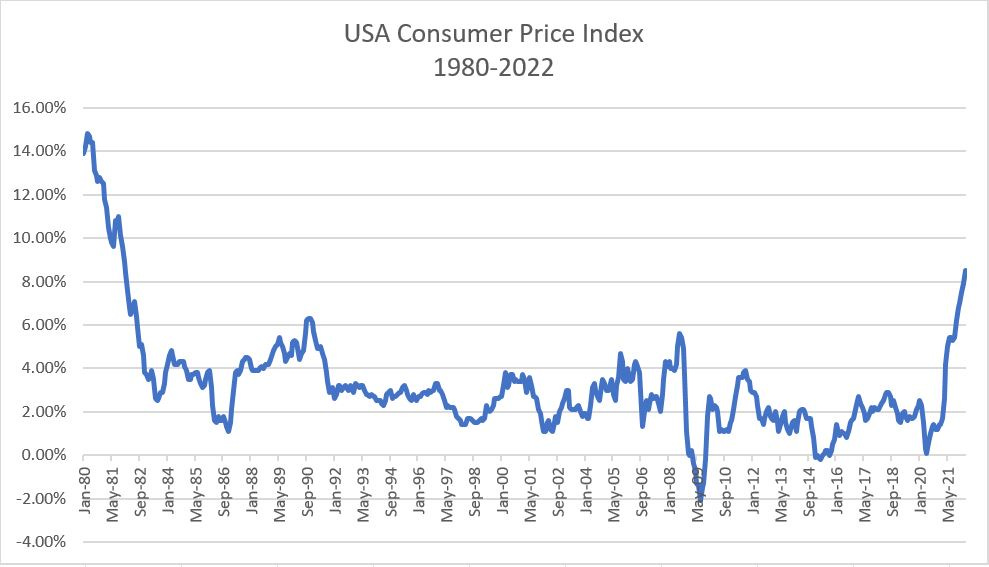

According to the Bureau of Labor Statistics, headline inflation hit 8.2% in March - the highest since January of 1982. For those who lived through 1970s era stagflation, the current numbers call back to a scary time where the average standard of living took it’s first real step backwards since WW2. Sure enough, real wages declined 2.4% over the same period as nominal wages only increased 5.8% which wasn’t enough to keep up with inflation.

As a result, inflation has shot to the top of issues for the 2022 election and the monkey poo is flying as GOP candidates try to blame Biden for inflation and the Biden administration tries to deflect responsibility by calling it “Putin’s price hike.”

While the blame component is certainly important in the context of elections, I find it more important to identify root causes so we can fix it! This of course is something I see little discussion of in our current media environment. So let’s dig in.

What is Inflation?

Inflation at its core is a monetary phenomenon. If we envision an economy with a fixed amount of goods and services, the amount of money available in circulation will determine the price level. More money = higher prices. Less money = lower prices. Of course, in the real world, the amount of money isn’t static, the economy grows and shrinks, and the productivity of various sectors relative to each other plus the changing costs of raw materials based on supply and demand can cause big swings in the measured numbers.

For example, the amount of money in circulation has grown by a large amount over time, but the cost of a TV has been flat or even declined over that same time even as the technology has greatly improved. The productivity gain in the sector overwhelmed the increase in the money supply. On the opposite side, the Arab oil embargo in 1973-1974 made energy more expensive in the absence of big changes in money supply. The cost of everything that used oil as an input went up and set the stage for the stagflation of the 1970s.

What’s Going on Right Now?

Let’s zoom in on the graph of inflation and focus on more recent timing.

I’ve labeled two important points on the graph. Before analyzing, I want to point out that each point on the graph is the sum of the previous 12 months of inflation. That means that in the 12 months leading up to Biden’s inauguration in January, 2021, inflation was measured by 1.4%. In the next 12 months ending January, 2022, inflation was measured at 7.5%.

Given that most of the increase occurred prior to the start of the Ukraine War and the increase started after Biden was inaugurated, it seems obvious that this is 100% Biden’s fault. While I think he deserves the lions share of the blame, the truth is more complicated. Inflation doesn’t take place instantly in an economy. If we suddenly inject $3 trillion in new dollars into the economy (like we did in 2020), prices don’t immediately adjust. If consumers limit their spending (perhaps due to a pandemic) and hold onto the cash, inflation might be delayed. Additionally, businesses don’t want to be the first in their industry to raise prices at a rate higher than historically. When that happens, you might have more cash chasing products and services than are available. Based on the laws of supply and demand, we would expect… shortages. Does that sound familiar?

The bottom line is that a decent amount of inflation should have been expected in 2021 regardless of what Biden chose to do based on the COVID relief bills passed in 2020 under Trump and a Democratic congress. The economy still needed to adjust - particularly as much of the country saw a return to something resembling normal. So why do I offer Biden the lion’s share of the blame?

Even with extra dollars floating around the economy, inflation in the short term can be driven by expectations. Pushing through yet another COVID stimulus bill when it wasn’t needed in early 2021 added significant fuel to the fire and grew inflation expectations that took on momentum over 2021.

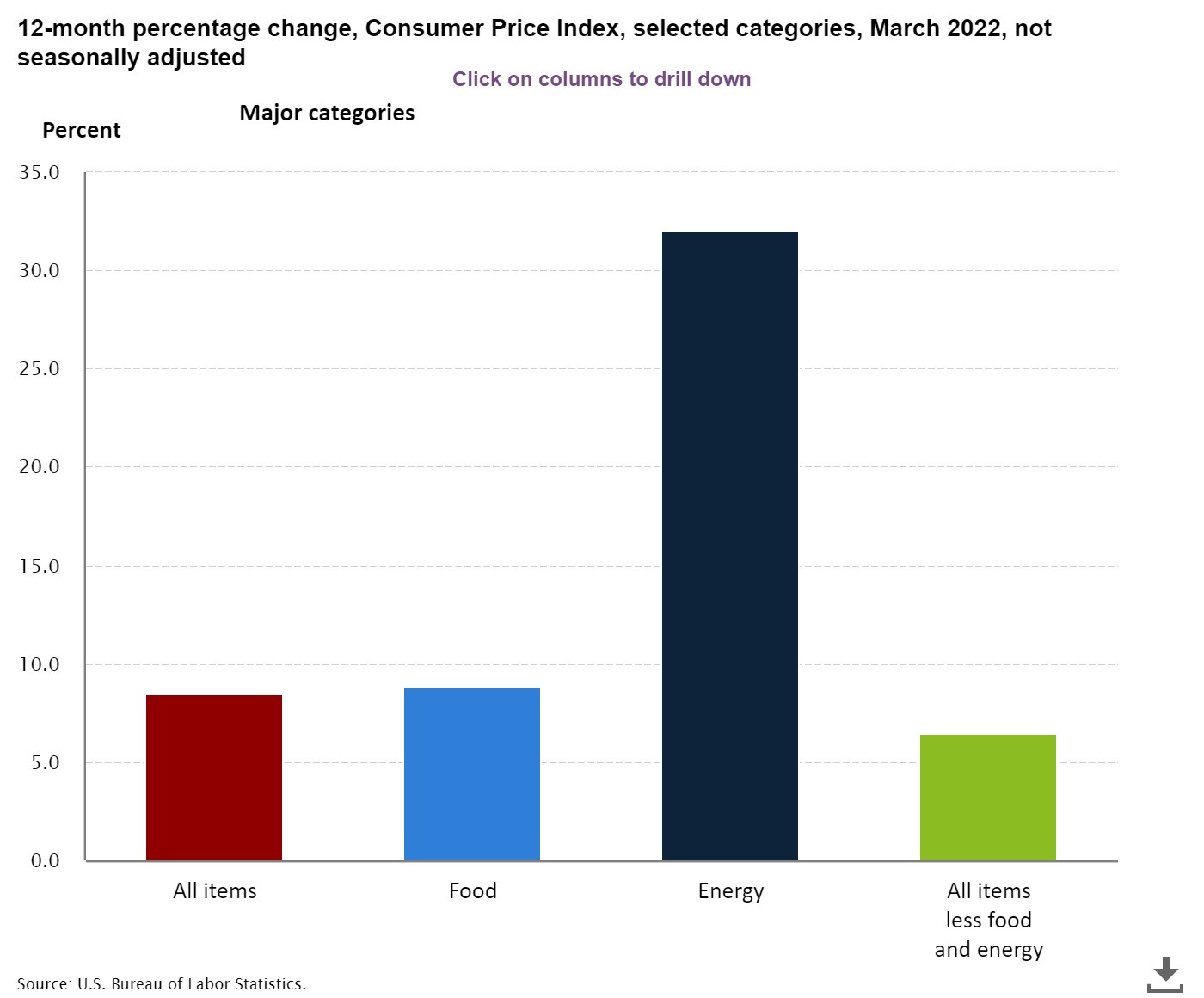

Biden took significant actions to restrict American energy production which had expanded greatly under Trump and had tempered inflation in 2020 by lowering the energy costs of goods and services. Oil prices were low, gas was cheap and transportation costs stayed low. This reversed quickly in 2021 under Biden’s administration.

Look at that - when we dig into the components of the CPI that increased, we see that it’s dominated by energy. Can we blame Putin for that? In March, 2022, very little, but we’re not done with the increase, so we’ll have to continue to monitor. While Biden isn’t directly responsible for Putin’s actions, I do think it’s fair to say that he emboldened Russia by making the USA and by extension Europe more dependent on Russian energy than under Trump.

What’s Next?

Unfortunately, the history of economic crisis is for politicians to panic and make things worse. First and foremost, do no harm - i.e. no more stimulus/relief. No price controls. Everyone in America who is at risk to COVID has access to vaccines and/or had COVID by now. It’s time to return to normal and allow industries to adjust to new economic conditions.

Second, we need to take the shackles off of American energy that Biden put in place. Allow drilling, allow pipeline construction. Most importantly, get back in the nuclear energy business. While more fossil fuels is a short term answer, over the long-term, only nuclear can provide the baseline electric load that can be supplemented with renewables. It’s ironic that some countries in Europe were shutting down nuclear plants even as they increased imports of Russian natural gas.

Lastly, take action to encourage productivity growth. Improved productivity can “absorb” some of those extra dollars. Reinstate Trump administration policies to address and repeal excess regulation.

As a teaching economist, this topic is obviously one that caught my interest. I agree with your analysis and, unfortunately, believe that this situation will only get worse before it gets better, primarily due to policy responses on behalf of the current group of politicians wielding control. Energy prices are the wildcard here, and while monetary policy ultimately drives long-run price changes (in this case inflationary), all goods have the costs of energy imbedded within them, whether it is due to production or logistics/distribution.

Anyway, keep posting these types of posts. I've followed you on FB for awhile but am not active there simply because of the climate surrounding thoughtful debate and the expression of opinions/facts outside of mainstream discourse. So in short, I'm welcoming the opportunity to engage more often.